The ethical training needs of the Bachelor of Accounting and Finance. Case study: University of Cienfuegos

Las necesidades de formación ética del Licenciado en Contabilidad y Finanzas. Caso de estudio: Universidad de Cienfuegos

A formação ética precisa do Bacharelado em Ciências Contábeis e Financeiras. Estudo de caso: Universidade de Cienfuegos

Yoania Castillo Padrón1![]() https://orcid.org/0000-0002-8460-0470

https://orcid.org/0000-0002-8460-0470

1 University "Carlos Rafael Rodríguez". Cienfuegos, Cuba. ![]() yoaniacp@ucf.edu.cu

yoaniacp@ucf.edu.cu

Received: January 15th, 2021.

Approved: Octuber 19th, 2021.

ABSTRACT

The training process of the university level students of the Bachelor of Accounting and Finance career, presented certain aspects that were analyzed and addressed in the research, to contribute to forming a professional committed to their work and to the society in which they are inserted, being able to solve problems, demonstrating ethical and professional ways of acting. In this sense, it is necessary to provide the student with a solid ethical training that allows him to face the work environment with responsibility. The objective of this work is to analyze the way of perceiving the ethical training of students of accounting sciences. In order to carry out this study, the elements stated in the curriculum of the career and the criteria of students, teachers and graduates were taken into consideration. Different methods are used, from the theoretical level the historical-logical, the analytical-synthetic and the inductive-deductive; of the empirical level, the documentary review, the survey, the interview, the triangulation in addition to the techniques of Mathematical Statistics. The results obtained demonstrate a marked dissatisfaction about the scarce provision of content that addresses professional ethics during the career, recognizing the need to promote and improve the ethical training of university accounting students to develop work practice in teaching units or labor entities base.

Keywords: teaching learning-process; ethical training; university responsibility; accountant training.

RESUMEN

El proceso de formación de los estudiantes del nivel universitario de la carrera Licenciatura en Contabilidad y Finanzas presentó ciertos aspectos que fueron analizados y abordados en la investigación, para contribuir a formar un profesional comprometido con su labor y con la sociedad en que se inserta, siendo capaz de resolver los problemas, demostrando modos de actuación éticos y profesionales. En este sentido, se requiere dotar al estudiante de una sólida formación ética que le permita enfrentar con responsabilidad el entorno laboral. El objetivo del presente trabajo consiste en analizar la forma de percibirse la formación ética de los estudiantes de las ciencias contables. Para la realización de este estudio se tuvieron en consideración los elementos enunciados en el pensum de estudios de la carrera y los criterios de estudiantes, profesores y egresados. Se utilizan diferentes métodos, del nivel teórico: el histórico-lógico, el analítico-sintético y el inductivo-deductivo; del nivel empírico: la revisión documental, la encuesta, la entrevista, la triangulación, además de las técnicas de la Estadística Matemática. Los resultados obtenidos demuestran una marcada insatisfacción sobre la escasa impartición de contenidos que abordan la ética profesional durante la carrera; se reconoce la necesidad de potenciar y perfeccionar la formación ética de los estudiantes contadores universitarios para desarrollar la práctica laboral en las unidades docentes o entidades laborales base.

Palabras clave: proceso de enseñanza-aprendizaje; formación ética; responsabilidad universitaria; formación del contador.

RESUMO

O processo de formação de alunos de nível superior do curso de Bacharelado em Ciências Contábeis e Finanças apresentou alguns aspectos que foram analisados e abordados na pesquisa, por contribuir para a formação de um profissional comprometido com o seu trabalho e com a sociedade na qual está inserido, sendo capaz de resolução de problemas, demonstrando formas éticas e profissionais de atuar. Nesse sentido, é necessário proporcionar ao aluno uma sólida formação ética que lhe permita enfrentar o ambiente de trabalho com responsabilidade. O objetivo deste trabalho é analisar a forma de perceber a formação ética de estudantes de ciências contábeis. Para a realização deste estudo, foram considerados os elementos constantes do currículo da carreira e os critérios dos alunos, professores e concluintes. São utilizados diferentes métodos, desde o nível teórico: o histórico-lógico, o analítico-sintético e o indutivo-dedutivo; do nível empírico: a revisão documental, o levantamento, a entrevista, a triangulação, além das técnicas de Estatística Matemática. Os resultados obtidos mostram uma acentuada insatisfação quanto à limitada oferta de conteúdos que abordem a ética profissional durante a carreira; É reconhecida a necessidade de promover e aprimorar a formação ética dos estudantes universitários de contabilidade para o desenvolvimento da prática laboral em unidades de ensino ou entidades de base trabalhista.

Palavras-chave: processo ensino-aprendizagem; formação ética; responsabilidade universitária; treinamento de contador.

INTRODUCTION

The professional training process, which articulates the substantive processes of instruction, extension and research from the university-labor scenario link, constitutes the basis for guaranteeing the integral development of the students.

According to Horruitiner (2009), the objective of the professional training process is to fully prepare the student in a certain university career and covers both undergraduate and graduate studies, an objective that can be achieved with the adequate integration of educational processes, developer and instructive.

It is for this reason that, on the training of the accounting and finance professional, research has been carried out by renowned authors. According to Gil, Garrido & Lorenzo (2015), these have as references many theoretical approaches about what in conceptual systems are known as studies on vocational training. Each of these theoretical contributions has highlighted the disciplinary aspect as a particular aspect, either assigning it connotations with a specific administrative function or to delineate a definition inherent to professional training. The results presented do not address the ethical training of the accountant as a component of the teaching-learning process.

The training of the Cuban professional in accounting sciences has been a permanent concern of Cuban Higher Education in recent decades. An evidence of this effort has been the evolution of the programs of the Accounting and Finance Career, which is studied in all the universities of the country. The national investigations of Aguilera, Gómez & Fuentes (2013); Rouco, Lara & Suárez (2014); Díaz et al. (2016); Varela, (2016); Castaño, R. et al. (2017); Lorenzo, Díaz & Gil (2017); Rodríguez, González & Ríos, (2019) focus their scientific results on the identification of deficiencies in educational work that limit ethical-professional behavior and that interfere with the quality of the graduate, the training of research-labor skills, the implementation of developer learning in students and the training of professional competencies in the main integrating discipline, in addition to addressing its methodological treatment to manage the training process of the accountant and propose the incorporation of contametry as a tool to measure accounting events; It is thus shown that, of the proposals studied so far, none deals with the ethical training of accounting science students.

Taking into account the criteria provided by the various authors consulted, it is considered that accountants have an obligation to the organizations they serve, as well as to their profession and the public, and to uphold the highest ethical standards for themselves in their conduct. The scarce knowledge of professional ethics in the accounting sphere, as well as the little emphasis placed on this subject in the training of future generations of accountants, has triggered the occurrence of criminal acts that affect the economy of the country. It is what was contributed by Díaz et al. (2016).

The university in the 21st century is a cosmopolitan space for ethical and axiological training, because it is where multiple factors converge, seeking a human sensitivity and housing a plurality of voices and goals, with extensive use of dialogue as a social tool; In addition, they have a direct influence on the professional future. It is a place for the constant search for truth; it is open to the freethinking spirit, within the frameworks imposed by social development. To the above is added the commitment of teachers and managers in terms of ethical and axiological training in students, due to the meaning that this represents for humanity in terms of the performance of the future professional of Engineering in Accounting and Auditing (Gamarra et al., 2016). This group of authors defends the criterion that ethical training is promoted from the system of training actions and on the basis of a logic that intentionally favors an improvement of the teaching function in interaction with others, which allows the future accounting and auditing professional an improvement in their performance, which is shared by the researcher.

It is impossible to deny the relevance of the consideration of actions that enhance the ethical training of the accounting professional from the thematic nuclei that make up the syllabuses.

Hence the need for the ethical training of accounting professionals to become the main challenge of current Cuban universities and that they contribute to the positive change of current social models, since these are the centers in charge of transforming it for the common good of society, which implies using approaches to the teaching-learning process aimed at the integrality of said process, as a result of the changes that occur in the international context and that have repercussions in the country.

In this scenario, and taking into account the standardization of the teaching and educational processes of professionals in the accounting sciences, the International Federation of Accountants (IFAC) has proposed a new model for training accountants, with a look at the international context, with those established by the International Accounting Standards (IES), which among its objectives proposes good practices for the generations of accountants who are gradually trained in universities, guided by the eight norms established in the code of ethics and the International Standards of Education Accountant, to achieve recognition as a Professional Public Accountant.

Taking into account the review of the previous publications of various authors worldwide, it was possible to show that, within the ethical and professional training provided by the Public Accounting programs in different universities in various countries, there is a deficiency in terms of education that is being given to students in this matter. The general objective of the research is to analyze the way of perceiving the ethical training of the students of the Bachelor's degree in Accounting and Finance at the University of Cienfuegos.

MATERIALS AND METHODS

Among the methods and techniques used in the research, those of the theoretical level can be referred to, such as: the historical-logical, linked to the construction of the theoretical framework to analyze the evolution, characterization and determination of development trends of the object of study; the analytical-synthetic, for the processing of information, both theoretical and empirical; as well as the inductive-deductive, in the determination of the theoretical and methodological foundations, which allows generalization and reaching conclusions.

On the other hand, empirical level methods are used such as: documentary review, to specify the analysis of official documents that regulate the professional training process of university students; the survey; the interview; triangulation; in addition to the methods, techniques and procedures of Mathematical Statistics for the processing of the data obtained.

The research adopted a qualitative / quantitative and exploratory design. The work guides were prepared from the following sources of information:

- Data on the students of the Bachelor's degree in Accounting and Finance.

- Data on the teacher training of the professors of the Department of Accounting Studies of the University of Cienfuegos.

- Survey applied to students enrolled in the Bachelor's degree in Accounting and Finance.

- Survey of graduates of the Bachelor's degree in Accounting and Finance.

To carry out the study, the following were designed: structured surveys using the Likert scale technique and with closed questions; individual interviews, using an open-ended questionnaire. These instruments were validated by the working group made up of professors, specialists and researchers from the Accounting and Finance career.

A total of 107 students from the Accounting and Finance career participated in the research, being the population, according to information obtained from the SIGENU of the Faculty of Economic Sciences. A simple random sampling is used to a sample of 107 students, which constitutes 100% of the population, being stratified as follows: 23 first-year students, 20 second-year students, 12 third-year students, 22 students of fourth year and 30 fifth years.

16 graduates of the Bachelor's degree in Accounting and Finance participated, constituting the population enrolled in the edition of the Specialty in Accounting and Financial Management for Tourism; the sample consisted of 16 graduates, that is, 100% of the population. A population and sample of 15 professors who are members of the department-career also participated, organized in the following way: seven are heads of discipline, the head of the career, five Principal Professors of the Year and the other members of the faculty.

The information obtained was processed using the SPSS statistical package, version 22 V.22 for Windows. It was triangulated to confirm the scientific rigor of the study carried out, from the collection and processing of the data, from different angles to compare and contrast them with each other.

RESULTS

The analysis of the answers provided by the students allowed evaluating the 19 criteria measured in terms of the degree of importance that they have on the accounting profession, from subdividing them into two sections; the first if taught during the career and the second includes important aspects for the profession. The following table shows the results of the processing.

Table 1- Summary of the survey applied

Years |

It is taught during the career |

Importance in the Profession |

|||||

Any |

Ever |

Pretty |

Any |

Something |

Pretty |

Much |

|

1st |

60.76% |

26.88% |

12.36% |

43.27% |

23.22% |

19.26% |

14.25% |

2nd |

55.79% |

18.95% |

25.26% |

50.79% |

26.32% |

13.42% |

9.47% |

3rd |

71.05% |

17.54% |

11.40% |

69.30% |

12.72% |

6.14% |

11.84% |

4th |

61.24% |

16.99% |

21.77% |

67.46% |

14.83% |

10.05% |

27.37% |

5th |

56.84% |

15.61% |

27.54% |

48.25% |

7.19% |

17.19% |

27.37% |

Graduates |

65.46% |

13.82% |

20.72% |

54.61% |

3.95% |

14.80% |

26.64% |

As shown in the above table, the year that stands out is 3 rd year, as this year's 71.05% of students believe that these criteria are not taught in the race, with the highest percentage, and only 11.40% consider that a lot is taught. In addition, regarding whether these criteria are important in their profession, 69.30% consider that they are not, only 12.72% that they are something important, while 6.14% and 11.84% state that they have quite and a lot of importance respectively. Another that stands out for being above 60% are graduates, since 65.46% believe that these criteria are not taught during the career and only 20.72% say that a lot is taught. One that also excels in terms of whether they have importance in the accounting profession criteria are subject to survey students 4 to year, since 67.46% say it does not matter.

Considering the responses to the survey, an analysis of the criteria issued by the students performed 3 rd and 4 to year career and graduates, whichever the two criteria that influence the results; These criteria are: knowledge of the ethical principles and obligations of the exercise of their profession, to know the degree of importance it has in the profession and ethical models of professional conduct, to know if it is taught in the career:

- 83.33% consider that ethical models of professional conduct are not taught in their career and only 16.67% say that they were ever taught it.

- 83.34% consider that it is not important to have knowledge of the ethical principles and obligations in the exercise of their profession and the rest think that something and a lot is taught, with 8.33% for both cases.

Making an analysis of the responses of the participants the following was found: the group with highest percentage of dissatisfaction was 3 rd year, since 71.05% of students believe that these criteria are not taught in the career, being the higher percentage and only 11.40% think that it is enough taught. In addition, regarding whether these criteria are important in their profession, 69.30% consider that they are not and only 12.72% that they are something important. Another that stands out for being above 60% are graduates, since 65.46% believe that these criteria are not taught during the career and only 20.72% say that a lot is taught. It also highlights, as to whether it matters in the accounting profession the criteria under surveys, the students of 4to year, since 67.46% say it does not matter.

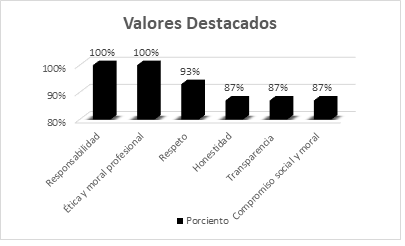

The interview carried out with the teachers to find out their criteria on the twelve values defined in the Educational Strategy of the career allowed verifying that 100% of them play a very important role in the training process of Accounting and Finance students, although the criteria they show different levels of recognition for the development of the modes of action of the learners; the most widely recognized values: responsibility, professional ethics and morals, and respect. The results are shown in Figure 1.

Graph 1- Career values

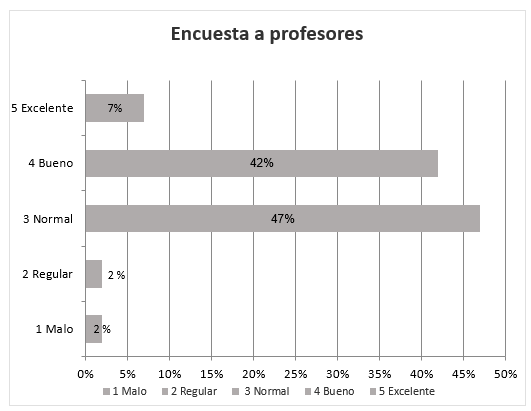

The survey applied to the professors of the career on the need to teach Ethics in the career allowed to identify that the predominant criteria are normal and good, expressed by 46% and 42%, respectively, presented in graph

Graph 2- Necessity of teaching Ethics

In addition, the main opinions on the previous criterion are presented, which reveal the needs that must be perfected at the career level because the teaching of professional ethics:

- Provides knowledge and a better view of accounting processes from a responsible perspective.

- The values to be developed in each subject must be deepened in work practice.

- It is important in the professional and work performance of students.

- It is necessary for the good professional development of graduates.

- To promote moral values and responsibility from the beginning of the profession.

- They are prepared with a broad cultural and professional level.

- Avoid participation in acts of corruption and illegalities in the business sector.

The interview carried out with the professors who belong to the optional / elective discipline and teach the optional subject 1 Accountant Ethics allowed listing the criteria that are presented below:

1. Some work experiences with professional ethics content in the training of students are the cases that are presented in the development of the elective subject: Accountant Ethics, in the Accounting and Auditing discipline.

2. They recommend that content on professional ethics be taught in some subjects of the professional profile such as: accounting and auditing; In addition, each discipline must intend to link with content that reflects adequate ethical behavior.

3. They also suggest some contents that are conducive to promoting the study of professional ethics, among which are:

4. The professors interviewed affirm that it is important that the graduate of the Bachelor's degree in Accounting and Finance should know about professional ethics, since they assure that it is the basis for their behavior as a graduate in different work situations, from processing, presentation and analysis of the information.

DISCUSSION

It is important to recognize that, in Higher Education, university social responsibility goes beyond carrying out the professional training process, competent, with a comprehensive preparation in correspondence with that required by the current moment and in accordance with the criteria of the global bodies of this process. The current university has the challenge of inserting itself in a complex world, with new demands, which is why it is in constant improvement to graduate citizens with a professional ethics appropriate to the social context, with critical thinking, committed to universal values (UNESCO 2009). The professional training process is required to help students to be informed and intensely motivated, prepared to analyze and seek solutions to society's problems, in a responsible manner.

Regarding the theoretical aspects addressed, the current demands of Higher Education in Cuba and the fundamentals of the curricular design of the Bachelor of Accounting and Finance career are assumed, to incorporate ethical modes of action to the accounting practice in the business environment, working as so that professional ethics training regulates the conduct of students.

Theoretical foundations of the research

The United Nations Conference on Trade and Development (UNCTAD), an organ of the Assembly of the United Nations (UN), has included accountant education on its agenda since 1985, thus showing its concern that it, as an agent of economic development, have the right technical knowledge to do its job. The Intergovernmental Working Group of Experts on International Accounting and Reporting Standards (UNCTAD / ISAR) formulated, in conjunction with other globally recognized organizations in the field of Accounting and Finance and representatives of educational institutions and international accounting firms , the World Curriculum for the Training of Professional Accountants, whose purpose is to guide the international community about the technical content that a student must master to be a professional accountant graduated in any country.

Michel & Arquero (2012), from Mexico, state that, in a truly objective response to the worldwide need to achieve a new graduation profile for accountants, UNCTAD is the one who makes the most concrete proposal with the publication of a model of the Plan of Study with worldwide application. From another country, such as Brazil, Oliveira, Veneroso and Carvalho de Souza (2009) carry out a contrast of the UNCTAD model in 11 Brazilian universities in the State of Santa Catarina, and found an 88.27% analogy with the model proposed by the aforementioned international organizations; Furthermore, they recognize the need to strengthen study plans with subjects that address the professional ethics of accounting science students.

Researchers from the context of Europe and Asia, among which are Evren (2017); Sengür (2017); Sepasi (2019), have focused on recognizing the value of ethics and its essential place in accounting education, highlighting the influence of corporate collapses to promote a growing demand for ethics courses in Accounting curricula. Thus, this constitutes a global problem, highlighting an analysis of ethical behavior based on the general rules and principles established by the governing bodies of the profession.

Taking into account the review of the previous publications of various authors worldwide, it was possible to show that, within the ethical and professional training provided by the Public Accounting programs in different universities in various countries, there is a deficiency in terms of education that is being given to students in this matter. Many authors talk about the importance of universities becoming aware of this and strengthening their responsibility in the field of professional ethics training, which coincides with the problem that the research is trying to corroborate.

In the case of study of the University of Cienfuegos, of the Bachelor's degree in Accounting and Finance, the aspects investigated show a predominant dissatisfaction in the students, as content on ethics and professional ethics was not taught during the career, with a limited reference to the Code of Ethics of the National Association of Economists and Accountants. The criteria expressed by students and graduates made it possible to identify non-recognition in the subjects taught of topics and contents that deal with professional ethics for the accountant, which made it possible to identify spaces in the curriculum that can be used to contribute to ethical and professional training.

The levels of importance for the profession of ethical training received show very low levels, as the criteria presented by students and graduates have been confirmed, confirming the need for intervention to achieve a better position that allows continuing teaching and educating responsible accountants.

The criteria presented by the professors reaffirm the need to promote the study of professional ethics and use case studies to illustrate the reality of the Cuban business environment, which demonstrates the latent difficulties in the methodological work of disciplines and subjects. A meticulous analysis is required by the career group to contribute to the improvement of the professional training process of the students of the Bachelor of Accounting and Finance career.

As a conclusion, the results obtained constitute a first approximation to the identification of the need to improve the ethical training process of the students of the Accounting and Finance career. It is essential to establish the inclusion of the contents of professional ethics from the different disciplines, so that they harmonize with each other, and contribute to the development of the accounting and financial professional so that they are able to face and solve professional problems in the work environment, demonstrating modes of action with a level of training in ethical values of the accounting profession.

BIBLIOGRAPHIC REFERENCES

Aguilera, S.M, Gómez, R, Fuentes, O. (2013). La formación del contador en Cuba, una necesidad para el ejercicio exitoso de la profesión. Revista BIG BANG Faustiano. 2(2). ISSN: 2307-2121. http://revistas.unjfsc.edu.pe/index.php/BIGBANG/issue/view/37

Castaño, R., Díaz, J.C & Mena, J.L. (2017). Concepción didáctica para la disciplina Contabilidad en el ciclo básico de la carrera Contabilidad y Finanzas de la Universidad de Pinar del Río. Revista Ciencias Pedagógicas e Innovación, 5(3), 27-37. https://incyt.upse.edu.ec/pedagogia/revistas/index.php/rcpi/article/view/213

Díaz Campanioni, A., Hermelo, C., Guerra, A., & Marcos, Y. (2016). Impacto de la ética en los profesionales de la contabilidad en la actualidad en Cuba., Revista Cubana de Ciencias Económicas EKOTEMAS, 2 (3), p 42-54. ISSN: 2414-4681. https://www.ekotemas.cu/index.php/ekotemas/article/view/138

Evren. D. (2017). Accounting ethics education in developing countries: the extent of accounting ethics education in Turkey. The Journal of International Social Research Cilt: 10 Sayý: 53, 10(53). Disponible en http://dx.doi.org/10.17719/jisr.20175334189

Gamarra, I.A., Reyes, J.J., Tinajero, C.F., Salazar, J.P., Orbea, E.M. & López, R.J. (2016). La formación ética y axiológica en el futuro profesional de Ingeniería en Contabilidad y Auditoría. Una mirada hacia la universidad. Didasc@lia: Didáctica y Educación, 7(1), 157-166. https://dialnet.unirioja.es/servlet/articulo?codigo=6568043

Gil Guerra, A., Garrido Cervera, M & Lorenzo Cabeza, Y. (2015). Sistema de acciones para la responsabilidad social de los trabajadores por cuenta propia en el Consejo Popular Capitán San Luis en el municipio Pinar del Río en el año 2012. Avances, 16(1), p. 44-53. ISSN 1562-3297. http://www.ciget.pinar.cu/ojs/index.php/publicaciones/article/view/66

Horruitiner, P. (2009). La universidad cubana: modelo de formación. La Habana: Ministerio de Educación Superior.

Lorenzo, Y., Díaz, T. & Gil, A. (2017). El proceso de formación de habilidades investigativo-laborales en los estudiantes de la carrera de Contabilidad y Finanzas. Revista Cubana de Educación Superior [online], 36(2), pp.157-168. ISSN 0257-4314. http://scielo.sld.cu/scielo.php?script=sci_arttext&pid=S0257-43142017000200015

Michel, G.P y Arquero, J.L. (2012). Análisis comparativo de los planes de estudio de la carrera de contaduría en las universidades mexicanas. (Ponencia). XVII Congreso Internacional de Contaduría, Administración e Informática. Ciudad universitaria, México D.F.

Oliveira, A., Veneroso, J., Carvalho de Souza, M.J. (2009) Análise comparativa entre os currículos dos cursos de Ciencias Contábeis das Universidades do Estado de Santa Catarina listadas pelo MEC e o currículo mundial proposto pela ONU/UNCTAD/ISAR. Gestao & Regionalidade, 25(75), 22-30. http://seer.uscs.edu.br/index.php/revista_gestao/article/view/186

Rodríguez Pérez, Acnerys, González Cruz, Ebir, & Addine Fernández, Fátima. (2021). El proceso de formación profesional del contador en Cuba. Un enfoque a la gestión de la disciplina principal integradora. Cofin Habana, 15(2), e15. Epub 29 de julio de 2021. Recuperado en 31 de octubre de 2021, de http://scielo.sld.cu/scielo.php?script=sci_arttext&pid=S2073-60612021000200015&lng=es&tlng=es

Rouco Albellán, M. Z., Mercedes Lara, D. L., & Suárez Suárez, D. G. (2014). Necesidad de promover el aprendizaje desarrollador en estudiantes universitarios. Universidad Y Sociedad, 5(3). https://rus.ucf.edu.cu/index.php/rus/article/view/120

Sengür, E.D. (2017). Accounting Ethics Education in Developing Countries: The Extent of Accounting Ethics Education in Turkey. The Journal of International Social Research. 10(53) ISSN: 1307-9581 http://dx.doi.org/10.17719/jisr.20175334189

Sepasi, S. (2019). Accounting Ethics. International Journal of Ethics & Society (IJES), 2(1)

Valera Fernández, L. (2017). Modelo pedagógico de la formación de competencias profesionales en la disciplina principal integradora de la carrera licenciatura en contabilidad y finanzas. Didasc@lia: Didáctica Y educación, 7(4), 17-26. Recuperado a partir de http://revistas.ult.edu.cu/index.php/didascalia/article/view/512. ISSN 2224-2643

Conflict of interest:

Author declares not to have any conflicts of interest.

Authors´ Contribution:

The author has participated in the writing of the work and analysis of the documents.

![]()

This work is under a licencia de Creative Commons Reconocimiento-NoComercial 4.0 Internacional

Copyright (c) Yoania Castillo Padrón